Ever caught yourself watching the closing bell on the stock exchange and wondering, 鈥淲ait, can I still trade after this?鈥?Welcome to the world of after-hours trading鈥攁 place where opportunity doesn鈥檛 sleep and markets keep moving long after the traditional 9:30 a.m. to 4:00 p.m. window. Whether you鈥檙e a casual investor or a seasoned trader, knowing when after-hours trading begins can give you the edge to act on breaking news, earnings reports, or sudden market swings before the next regular session.

After-hours trading refers to the buying and selling of stocks, ETFs, and other assets outside the standard trading hours of major exchanges like the NYSE and NASDAQ. Think of it as a second market that stays open when the rest of Wall Street clocks out. This period is particularly appealing to traders who want to react to late-breaking news, global market movements, or corporate earnings that are released after the bell.

For example, imagine a tech giant releasing quarterly earnings at 4:15 p.m.鈥攜ou don鈥檛 have to wait until tomorrow morning to trade. After-hours trading lets you respond immediately, potentially capitalizing on early market reactions.

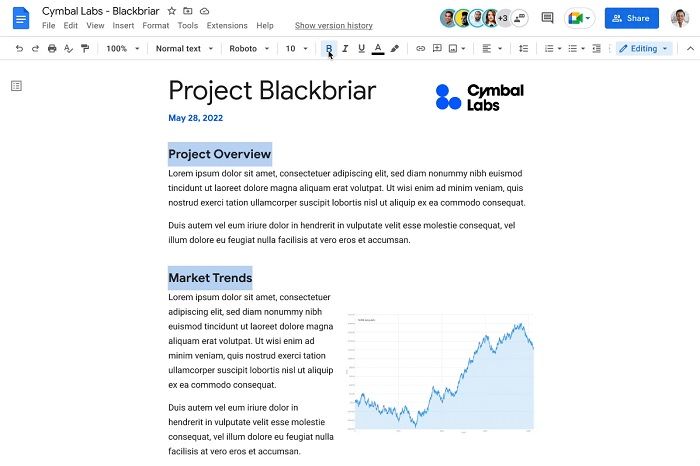

In the U.S., after-hours trading generally starts at 4:00 p.m. EST, right when the regular session ends, and extends until 8:00 p.m. EST. Some trading platforms even allow pre-market trading from 4:00 a.m. to 9:30 a.m. EST, which is technically 鈥渂efore hours鈥?but shares many of the same dynamics. These sessions are less liquid than the regular market, meaning price swings can be larger and spreads wider. This makes timing and strategy crucial.

1. React Quickly to News: Breaking news, earnings reports, or geopolitical events can move markets fast. After-hours trading lets you take action without waiting for the next day鈥檚 open.

2. Global Market Alignment: With forex, commodities, and crypto trading increasingly integrated into after-hours platforms, U.S. traders can react to market movements in Asia and Europe almost in real-time.

3. Flexibility for Traders: For those balancing work, family, or other commitments, after-hours trading opens up the possibility of trading at convenient times without missing critical market events.

4. Leveraging Advanced Tools: Modern trading platforms combine charting, AI-driven analytics, and decentralized finance (DeFi) tools to help traders make informed decisions even outside regular hours.

Trading after hours isn鈥檛 without risks. Lower liquidity can mean bigger price swings, and not all stocks are available for extended-hours trading. Orders may be partially filled or rejected entirely if volume is low. Using limit orders rather than market orders is generally safer to control entry and exit points.

Also, margin or leveraged trades during these sessions can magnify both gains and losses. Pairing leverage with after-hours volatility demands careful strategy鈥攖hink of it like driving a sports car on a narrow mountain road: exhilarating but risky without focus and skill.

After-hours trading isn鈥檛 limited to stocks. Forex, crypto, indices, options, and commodities all have platforms that allow extended trading hours. Crypto, for instance, never sleeps, providing a constant flow of opportunities. Similarly, indices like the S&P 500 futures continue moving after the cash market closes, reflecting global investor sentiment.

The convergence of these markets with web3 finance and decentralized exchanges is a game-changer. Traders now can interact with smart contracts, leverage AI-driven strategies, and manage assets in a more secure, transparent manner. Imagine reacting to a sudden crypto pump using automated smart contracts while your analytics dashboard visualizes potential risks and gains.

Decentralized finance is reshaping how after-hours trading could evolve. Smart contracts can automate trading strategies, reduce friction, and provide more transparency in markets traditionally controlled by centralized exchanges. AI-driven trading tools will help identify patterns across multiple asset classes鈥攕tocks, crypto, commodities鈥攚hile maintaining risk management protocols.

Challenges remain: regulatory clarity, security of DeFi protocols, and liquidity fragmentation are hurdles traders need to navigate. However, the trend is clear: faster, smarter, more flexible trading is coming, blending traditional market hours with continuous global markets.

For traders looking to take full advantage of after-hours sessions:

After-hours trading is where opportunity meets timing, and knowledge is your best ally. When the regular market closes, your trading journey doesn鈥檛 have to stop. Trade smarter, trade faster, trade beyond the bell.

After-hours trading may sound like a niche, but in a world moving toward web3, AI-driven trading, and decentralized finance, it鈥檚 increasingly a mainstream edge. The market never truly sleeps鈥攕o why should you? Understanding when after-hours trading begins is the first step to unlocking this continuous world of financial opportunity.