How to trade reversal candlestick patterns

How to Trade Reversal Candlestick Patterns

Introduction

If you’ve ever watched a chart breathe in and out, you’ve felt the rhythm behind reversals: a price action signal formed by a single candle can hint that the crowd mood is about to flip. Reversal candlestick patterns aren’t magic, but when you learn to spot them in the right context, they become reliable clues rather than noisy noise. This piece lays out practical ways to trade reversal candles across assets, with real-world tweaks for today’s markets and the evolving prop trading ecosystem.

Understanding reversal candlestick patterns

Reversal candles capture a moment of price rejection and momentum shift. They form at turning points—near strong trend lines or support/resistance zones, and sometimes with a surge in volume or a momentum cue from another indicator. The goal isn’t to chase every pattern; it’s to align pattern confirmation with higher timeframe context and risk controls. Think of candlesticks as a narrative and the chart as the plot: a sharp close, a long wick, or a doji signaling uncertainty ahead of a potential breakout in the other direction.

Trading logic and setup

- Context first: identify the prevailing trend on a higher timeframe, then look for a reversal pattern on a lower timeframe for a precise entry.

- Confirmation matters: wait for a closes beyond the pattern’s high/low or a follow-up candle in the anticipated direction, ideally with rising volume.

- Risk discipline: define a stop beyond the pattern’s extremities, and keep reward-risk in check by aiming for a minimum risk-reward ratio (often 1:2 or better).

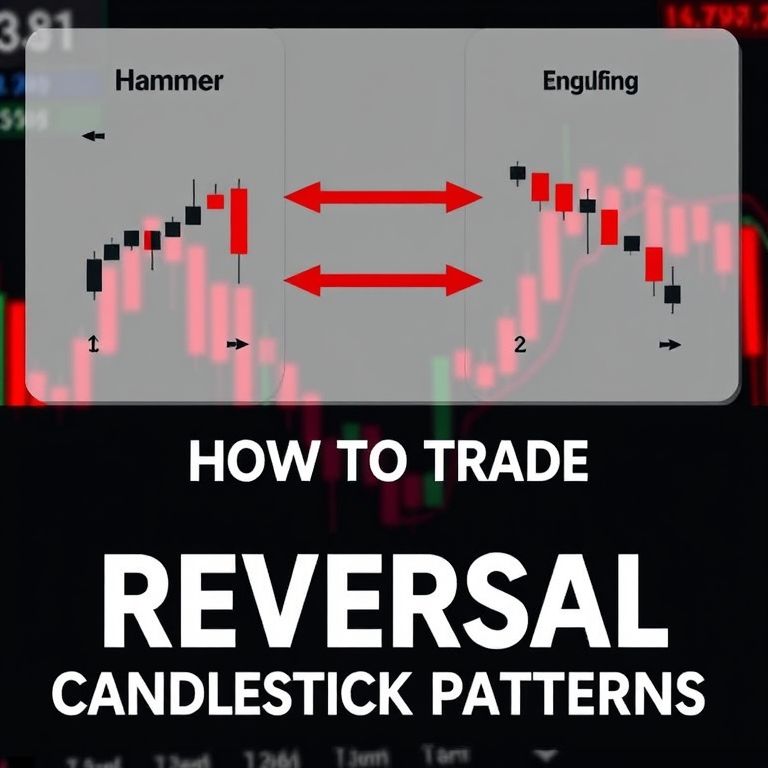

Key patterns to know

- bullish engulfing and bearish engulfing: a small candle followed by a larger opposite candle that “engulfs” it; entry on the close of the engulfing candle with stops below/above the pattern.

- hammer/inverted hammer and shooting star: signal potential reversal after a downtrend or uptrend, entry after confirmation, use nearby swing levels for stops.

- doji and harami/harami cross: indicate indecision; stronger when paired with price rejection and volume; tradeable with cautious sizing.

- morning star and evening star: three-candle patterns that mark a turning point; best when aligned with a trend flip and a nearby support/resistance zone.

Patterns are more robust when combined with a momentum read (RSI divergence, MACD cross) and a clean price action around key levels.

Caveats and reliability tips

- Don’t chase patterns in bland markets; quality fades in range-bound chop.

- Look for confluence: a reversal candle near a trend line, Fibonacci level, or moving average increases odds.

- Use multiple timeframes: a daily pattern with an intraday confirmation often yields better reliability than a single timeframe signal.

- Consider slippage and liquidity: liquidity constraints in forex/indices can affect the risk envelope; crypto may show wilder moves.

Applying across asset classes

- Forex and indices: strong trends plus clear support/resistance; patterns can offer repeatable entries with measured risk.

- Stocks and options: gaps can distort candle signals; use options as a hedge or to define limited risk.

- Commodities: seasonal themes and inventory news can amplify reversals; align with macro catalysts.

- Crypto: volatility brings opportunities but increases risk; tighten stops and verify with volume.

DeFi, challenges, and prop trading outlook

- DeFi and price discovery: decentralized venues enable rapid access but bring front-running, price manipulation, and smart contract risk. Reversal signals still matter, but execution reliability can vary.

- Smart contracts and AI: expect more automated pattern recognition, backtested on-chain data, and smart-order routing to implement signals automatically.

- Prop trading momentum: prop desks chase edge with disciplined risk controls; reversal candlestick patterns offer a scalable edge when paired with solid process and strict capital hygiene.

Future trends and slogans

- Smart contracts could turn pattern recognition into one-click entries with safe automation.

- AI-driven screening and risk modelling may raise win rates, but human oversight remains essential.

- Slogan: Trade the signal, not the hype. Reversals start with candlesticks, and stay alive with discipline.

Closing thought

Reversal candlestick trading blends art and science: a bit of pattern lore, a dash of context, and robust risk rules. With the right frame, you can turn a single candle into a repeatable edge, across forex, stocks, crypto, indices, options, and commodities. For those pushing into prop trading or DeFi futures, the candlestick story remains a practical compass—clear, testable, and adaptable to the next wave of market structure.

YOU MAY ALSO LIKE